A bad loan (Non-performing asset) is written off after all avenues of recovery are exhausted and chances of recovery of due loan seem remote. To clear the balance sheet, all such kinds of loans are written off once for all. This is different from a loan waiver which is the cancellation of recovery or refraining from collection of dues

Banks never assume they will collect all of the loans they make. This is why generally accepted accounting principles (GAAP) require lending institutions to hold a reserve against expected future bad loans. This is otherwise known as the allowance for bad debts.

For example, a firm that has disbursed $100,000 in loans might have to provide as an allowance for non payment of 5%, or $5,000, in bad debts. Once the loans are made, this $5,000 is immediately taken as an expense as the bank does not wait until an actual default occurs. The remaining $95,000 is recorded as net assets on the balance sheet.

To write of a loan in LPF the user should have proper user access rights to post the write off the transaction.

How to write of Loans

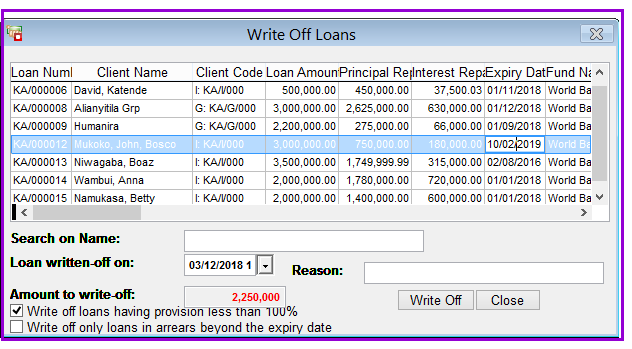

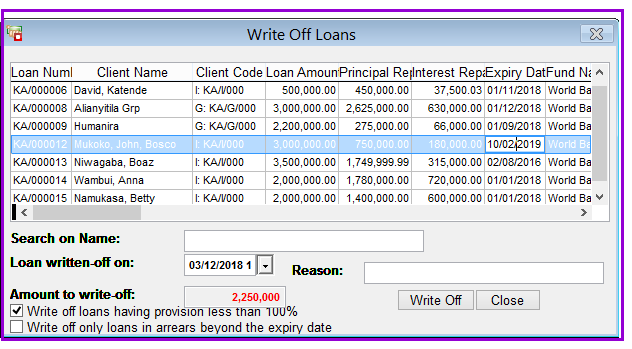

To write off loans you go to Loans/Write off Loans and a screen like the one below shows up:

Write off loans having provision less than 100%: When this option is ticked all loans in arrears will appear in the grid and the user should be able to select even loans whose provision for write off is less than 100%. Which would be the ideal standard practice. This is supposed to take care of loans whose chances of recovery are hat are

Click on the Write off command button to complete the write off or on the Close command button in order to exit without writing off.

In Loan Performer when you write off a loan it ceases to be an asset but effectively becomes an expense in as far as is not covered by the loan loss reserves.

At the time when the provision for Loans loss is made then the following bookings will be made:

Provision Costs A/C (P & L) Debit

Provision for Bad Loans A/C (Balance) Credit

When the loan is actually written off the following bookings are made

Provision for Bad Loans A/C (Balance) Debit

Loans Written off A/C (Balance) Credit

In case the Loan is repaid later then the following bookings will be made:

Cash (Balance) Debit

Recovery of Loan Written off A/C (P&L) Credit

The Nº 1 Software for Microfinance